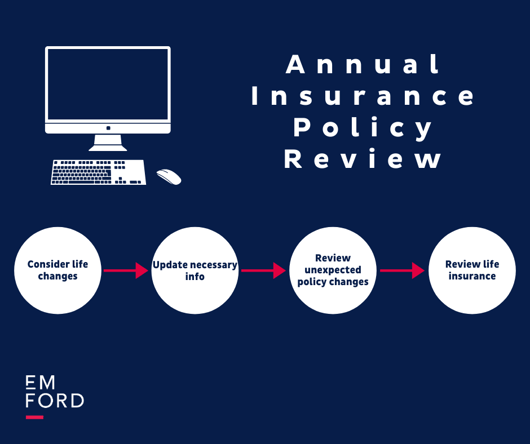

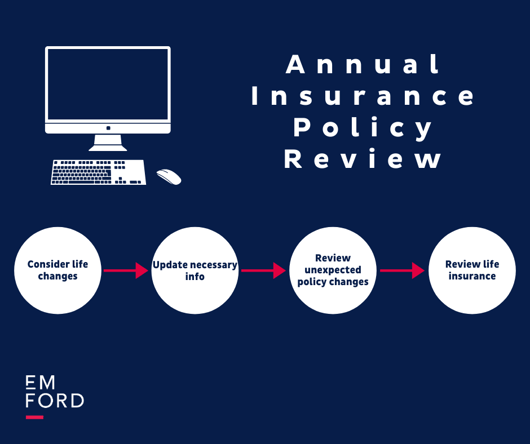

National Insurance Awareness Day is June 28 and no matter if you are insuring a home, automobile or if you are insuring a business, this day is a great opportunity to review your insurance policies and ask yourself a few key questions.

1. How has my life changed this year?

The impact of COVID-19 on

multiple aspects of our lives may have brought on more changes than usual. Sitting down to reflect the big ways our lives have changed-- whether it's a new car, different home, new health circumstances, etc.-- and ensuring your insurance policies reflect and support these changes in circumstances is important. Does your current coverage and policy speak to your life?

2. Is my information accurate and up to date?

If you've seen major life changes as mentioned above, have you reported these changes or updates in information to your insurance company? There are so many adjustments to make to our information when we move, have a change in marital status, buy a new car, etc., but reporting these to your insurance carriers is crucial in keeping your policy and coverage up to date, and can point out any noticeable gaps in coverage you may need to address.

3. Does my policy contain any unexpected changes?

Review your policy and look for any adjustments. Some changes are legitimate and can be explained by your carrier, but sometimes these could be errors. Before you send off your usual payment, review each policy carefully to know what you are paying for.

4. When is the last time I've reviewed my life insurance policy?

It's common for us to get a life insurance policy and file it away for years at a time, but we really need to be reviewing these annually. As we age, we have to continue to double check these policies and make updates as necessary.

Have you asked yourself these key questions and are left with even more questions? That's okay. If you find yourself overwhelmed with the steps in reviewing and adjusting your insurance plan, we encourage you to reach out to your insurance agent or advisor. Walking through your plan with an insurance professional can help you understand if your plan is still a good fit for your current circumstances and can present you with further options to ensure you get the coverage you need at the best cost.

At EM Ford, we're here for you. If you need assistance in reviewing your policies, contact us and one of our advisors will walk you through this process.