It’s difficult to imagine functioning in today’s world without credit. Whether buying a car or purchasing a home, credit has become an integral part of our everyday lives. Having easy access to credit goes hand in hand with having a good credit score, so it’s important to know how to maintain a positive credit score and credit history.

The Importance of Having a Good Credit Score

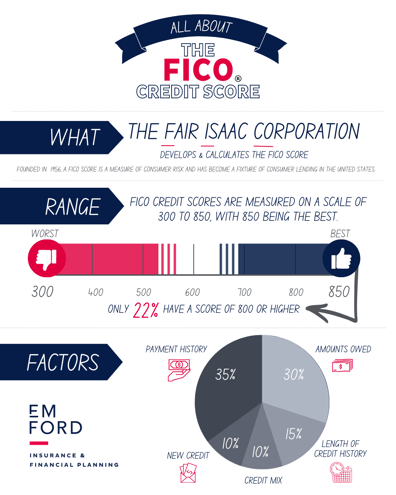

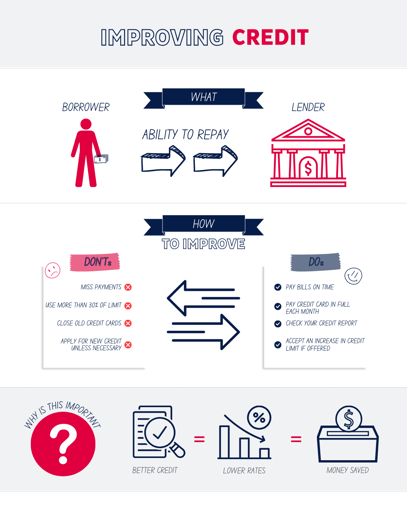

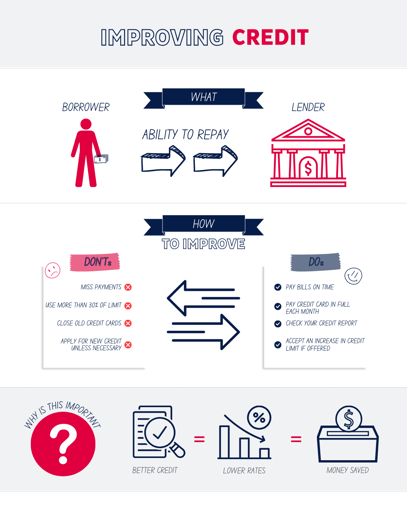

Your credit score is based on your past and present credit transactions. Having a good credit score is important because most lenders use credit scores to evaluate the creditworthiness of a potential borrower. Borrowers with good credit are presumed to be more trustworthy and may find it easier to obtain a loan, often at a lower interest rate. Credit scores can even be a deciding factor when you rent an apartment or apply for a new job.

How is your credit score determined? The three major credit reporting agencies (Experian, Equifax, and TransUnion) track your credit history and assign you a corresponding credit score, typically using software developed by Fair Isaac Corporation (FICO).

The most common credit score is your FICO score, a three-digit number that range from 300-850. What’s a good FICO score? For the most part, that depends on the lender and your particular situation. However, individuals with scores of 700 or higher are generally eligible for the most favorable terms from lenders, while those with scores below 700 may have to pay more of a premium for credit. Finally, individuals with scores below 620 may have trouble obtaining any credit at all.

Factors That Can Negatively Impact Your Credit Score

A number of factors could negatively affect your credit score, including:

- A history of late payments. Your credit report provides information to lenders regarding your payment history over the previous 12 to 24 months. For the most part, a lender may assume that you can be trusted to make timely monthly debt payments in the future if you have done so in the past. Consequently, if you have a history of late payments and/or unpaid debts, a lender may consider you to be a high risk and turn you down for a loan.

- Not enough good credit. You may have good credit, but you may not have a substantial credit history. As a result, you may need to build your credit history before a lender deems you worthy of taking on additional debt.

- Too many credit inquiries. Each time you apply for credit, the lender will request a copy of your credit history. The lender’s request then appears as an inquiry on your credit report. Too many inquiries in a short amount of time could be viewed negatively by a potential lender, because it may indicate that you have a history of being turned down for loans or have access to too much credit.

- Uncorrected errors on your credit report. Errors on a credit report could make it difficult for a lender to accurately evaluate your creditworthiness and might result in a loan denial. If you have errors on your credit report, it’s important to correct your report, even if it doesn’t contain derogatory information.

How to Access Your Credit Report for Free (And Legitimately)

Every consumer is entitled to a free credit report every 12 months from each of the three major credit reporting agencies. Visit AnnualCreditReport.com for more information.